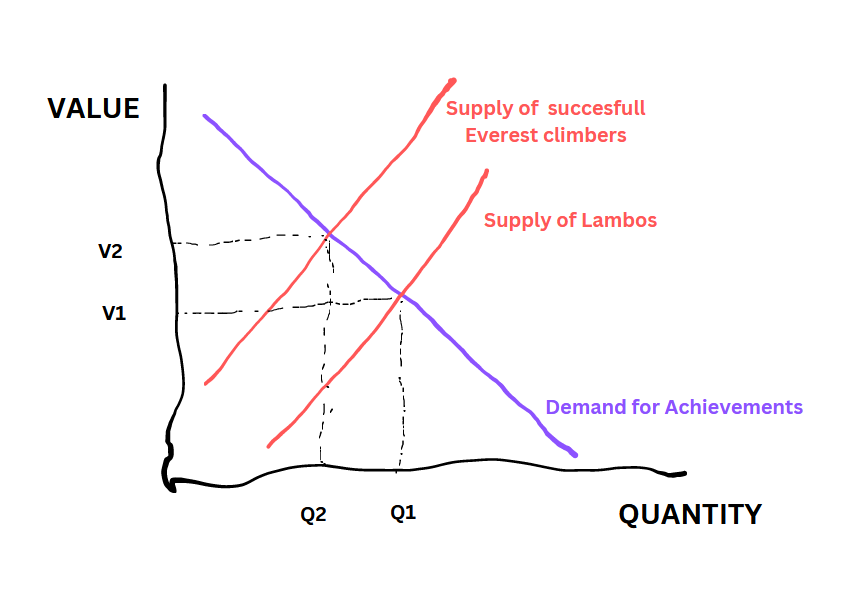

If AI and robotics make everything abundant content, code, cars, even creativity, so what still holds value?

I just came back from two months in the Philippines.

Spent a week in a beachfront hut near El Nido, Palawan – a tiny village of maybe 30–50 homes, most of them local fishermen.

It was raw, peaceful, alive. Jungle road access. Sunset beers from the one bar. Starlink WiFi, surprisingly.

For someone who stares at screens all day, it felt like a nervous system reboot.

I wasn’t just relaxed, I felt reset.

I started wondering: what would it take to live here? Or build something?

So I asked around. And what I found shocked me:

Beachfront land. 20 meters from the sea. $50,000.

Enough to build a few villas. Run a retreat. Or just own a slice of future scarcity.

That same kind of place in Southern Europe would cost 3–10x more with less nature, more tourists.

And the more I think about it, the more I see the asymmetry:

- India + China = 3B people, rising income, close by (3h by plane from Shenzhen)

- Global screen-fatigue is real — people want off-grid, nature, presence

- If AI makes everything abundant, this becomes what’s rare: beauty you can’t replicate

An eco-luxury retreat in Palawan isn’t just a lifestyle dream.

It’s underpriced — even by today’s standards.

The nature is rare. The vibe is unmatched. The cost is low.

To put things in perspective:

The Philippines has over 36,000 km of coastline.

If you take just 100 meters inland across that stretch, you’re looking at 3.6 million decares of potential land.

Even if only 30% of it is realistically usable (excluding cliffs, mangroves, protected zones, etc.), that’s 1 billion square meters.

At a modest $50 per square meter, the market is already worth $50 billion.

But if developed properly – with infrastructure, access, and international interest (especially from nearby giants like India and China) – that value could easily 10x.

That’s a $450 billion economic opportunity.

Even capturing just 0.1% of that = $450 million.

But this isn’t something you can unlock remotely.

Someone needs to be on the ground – living it, understanding the place, the people, the rhythm.

And if that means waking up in one of the most untouched, beautiful places on Earth while opening up access to a hidden market?

Not a bad life.

I’m thinking of scouting more spots like this and building a simple public spreadsheet to track them.

If you’re seeing the same opportunity or want to help map it – let’s talk.

I am also on Twitter – you can contact me there or follow me for more stories and opportunities.

EDIT: Turns out, foreigners can’t own more than 40% of a property in the Philippines.

So capital’s locked out and prices stay low.

Yes, there are workarounds, but they’re not simple.

Still, the beachfront plots seem so underpriced…